Tax Planning Benefits of Making a Section 83(b) Election

As a startup founder or an executive of a public or private company, if you receive restricted stock awards or options as part of your compensation package, there may be substantial tax benefits in making an election under Section 83(b) of the Internal Revenue Code.

What is an 83(b) election?

In practice, an 83(b) election is simply a letter you send to the Internal Revenue Service. Under current tax rules, restricted stock is taxed based on the fair market value on the date it becomes vested and when exercised after vesting. Filing a Section 83(b) election, however, notifies the IRS that you wish to be taxed on the fair market value of the restricted stock or the spread of stock options when you receive the grant rather than when it vests.

Only stock or option grants subject to vesting are eligible (grants of fully vested stock are subject to taxation at the time of the grant) and must be subject to a substantial risk of forfeiture before vesting (example: you could lose the shares if you left the company before they are vested, or if you failed to achieve certain milestones articulated at the time of the grant). Restricted Stock Units (RSUs) are not eligible for this.

What are the potential tax benefits?

Making an 83(b) election can potentially save you a significant amount in taxes over time. Choosing to shift taxation of restricted stock or options based on the fair market value at the time of grant can result in substantially less taxes than when based on the fair market value on the date of vesting (or exercise), especially if the value of the stock then appreciates significantly.

Example

Let’s assume that you are granted 100,000 shares of restricted stock. Your vesting schedule spans four years, with 25% of the grant vesting each year. On the first anniversary of your grant date, 25,000 shares vest, and the same happens for the next three years after that, fully vesting in year four. You decide to sell the shares once they vest each year. Your marginal tax rate is 37%, and you are subject to the Net Investment Income Tax of 3.8%. The stock is valued at $1 per share at grant and increases by $1 annually when the stock vests.

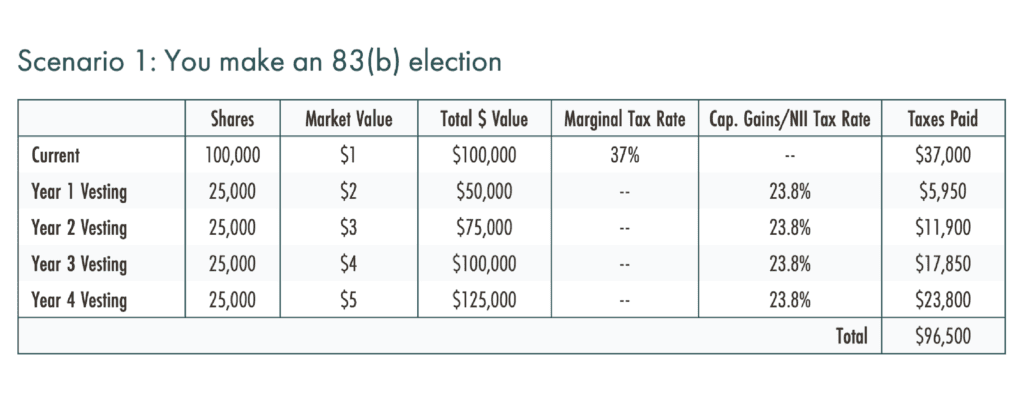

In this first scenario, you decide to make an 83(b) election within the first 30 days of the grant. You plan to sell the shares immediately at the time of vesting, thereby incurring no capital gains.

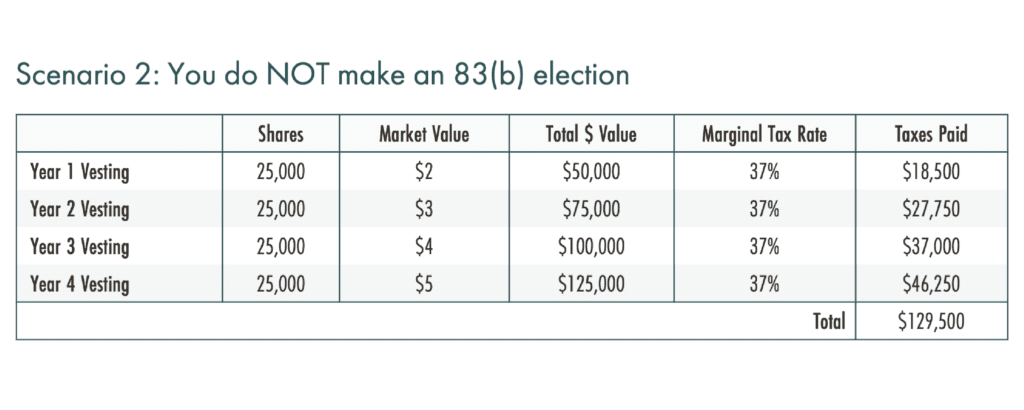

In this scenario, you decide not to make an 83(b) election and instead to incur ordinary income tax each year as shares vest. You plan to sell the shares immediately at the time of vesting, thereby incurring no capital gains.

As you can see through comparing these two scenarios, the decision to make an 83(b) election would result in substantial tax savings over time for this individual.

What are the potential risks?

Although there is a solid case for making an 83(b) election in many cases, some risks should be carefully considered before doing so.

- Cash on Hand – Making an 83(b) election requires having enough cash to pay taxes up front and accelerates the exercise of any stock options. When you choose to not file an 83(b) election, cash often becomes available to cover any tax liability upon the vesting of the shares.

- Substantial Risk of forfeiture – Section 83(b) election is only allowed if there is a risk of forfeiture. If you leave the company before the vesting date or do not meet certain performance milestones, you will have forfeited the shares or options and thus will have paid taxes on the compensation you never get to realize.

- There is no price appreciation – making an 83(b) election and immediately incurring taxes makes economic sense if the stock price or options meaningfully appreciate over the vesting schedule. If they do not, the price drops, or the company fails, you may pay more taxes than necessary.

- Tax rates change – there is always the risk that changes are made to the tax code and expected differences in ordinary income rates versus long-term capital gains rates, which made economic sense at the time of making an 83(b) election, are no longer sufficiently different enough for there to be a benefit at the time of vesting.

How to file an 83(b) election

Making an 83(b) election is relatively simple, though time-sensitive. Within 30 days of the board approving the restricted stock or options grant (note: not when you receive the paperwork, but the date of the grant itself), you must submit a letter – there is no official IRS form for this – to the Internal Revenue Service letting them know you are making “Section 83(b) Election” and you’d like to be taxed.

The letter should include:

- Your name, address, and Social Security number

- A description of the restricted stock award (number of units, price, etc.)

- The date of the grant and the year for which you are making the election

- The nature of the restrictions on the grant (ex: forfeiture if employment terminates before vesting)

- The amount you paid for the grant (if any)

- The fair market value at the time of the grant

- A statement that you have provided copies of the 83(b) election to your employer as required by the law

Typically, 83(b) elections should be sent to the Internal Revenue Service via certified mail with a return receipt. The IRS has announced that it will temporarily allow Section 83(b) elections to be signed digitally or electronically instead of requiring handwritten signatures through October 31, 2023.

A copy of the letter must also be provided to the employer (HR or Benefits can typically point you in the right direction for this). Depending on the state you reside in, you may have to attach a copy of the letter to your state personal income tax return the year you make the election (your tax professional can advise on this).

Check with your company to see if they have a standard form used by all executives. The 83(b) election with your company info may already be included in your equity grant documents to be signed and mailed to the IRS.

In summary

There are good reasons why you might want to make an 83(b) election. Still, it is a decision that should be made only after careful consideration of all the variables, risks, and your unique situation. The subject matter experts at Brighton Jones, working alongside your Personal CFO, are well positioned to assist you in analyzing this and any other equity compensation planning issues that might arise.