Bitcoin Futures ETFs Start Trading, But Buyer Beware

Bitcoin futures and commodity-based ETFs tell a captivating story about growth.

Since the first Bitcoin Futures ETF started trading on October 19, we can draw some comparisons with various commodity-based ETFs. To be more specific, comparisons in the deviation from the change in the spot price of the underlying commodity.

The decision to purchase units of Bitcoin was initially viewed as a matter of political philosophy. Today, that philosophy is reaching a broader audience.

For investors who like the idea of having exposure to cryptocurrencies yet don’t want to learn the ins and outs of buying and owning it directly, an exchange-traded product that can be purchased in a standard brokerage or retirement account might seem like the ideal solution.

But, just as we saw with various commodity funds over the years, it’s not so cut-and-dry. The return of owning futures contracts can differ from the simple change in the spot price of the underlying commodity or asset.

Spot Price and Other Bitcoin ETF Considerations

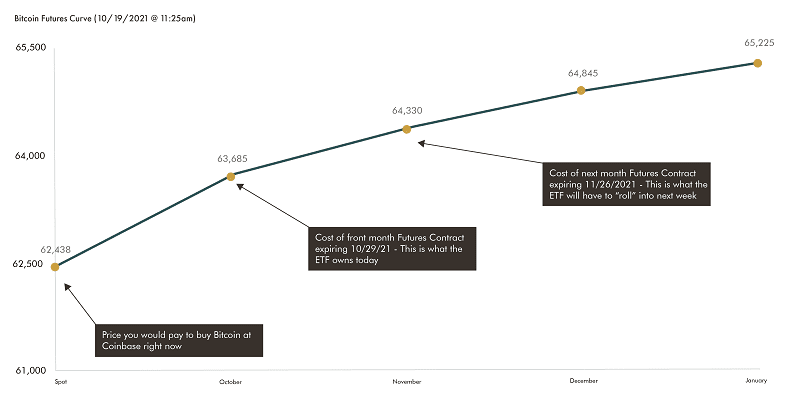

A buyer could purchase Bitcoin at Coinbase for $62,438 on October 19, referred to as the spot price. However, the ETF does not and cannot own Bitcoin directly; it has to gain exposure through derivative contracts called futures.

Futures contracts are agreements to buy or sell a commodity, asset, or security at a predetermined price at a specified, future time. These agreements trade on exchanges, similar to other financial securities.

As is the case with futures contracts on commodities or other financial assets, you can transact in Bitcoin futures that expire this month, next month, and so on. The futures chain is a series of contracts with different maturities. The diagram below shows the current futures chain for Bitcoin.

In order to most closely approximate changes in the spot price of Bitcoin—the day-to-day changes in the price quoted in CNBC or Coinbase—an ETF buys the front month futures contract. This is simply the contract with the closest expiration date.

Currently, the ETF is likely transacting in the October futures contract, which has a price of $63,685. That’s a 2 percent premium above what a buyer is able to pay at Coinbase right now. What’s more, the October contract will expire at the end of the month, so the fund will need to roll over its holdings to the November contract. That contract currently trades at $64,330.

The process of moving from the front month contract to the next month contract creates a roll yield. To calculate the roll yield, divide the price of the contract the ETF needs to sell (October) by the price of the contract the ETF needs to buy (November), and then annualize the figure:

(63,685 / 64,330) ^ 12 – 1 = -11.4%.

Hidden Consequences of the Futures Chain

The dynamics of the futures chain can change and become flatter or steeper. Because of that, the performance of the ETF could ultimately lag changes in the spot price of Bitcoin by more than 10 percent per year. That’s before we even factor in the 0.95 percent management fee.

If the slope of the futures chain flattens, the cost to roll over contracts will decrease. If the slope remains as steep as it is now, or gets steeper, investors who buy the ETF are likely to be surprised and disappointed by the degree a futures-based Bitcoin strategy can deviate from changes in the spot price of Bitcoin.

Comparing Oil and Bitcoin Futures

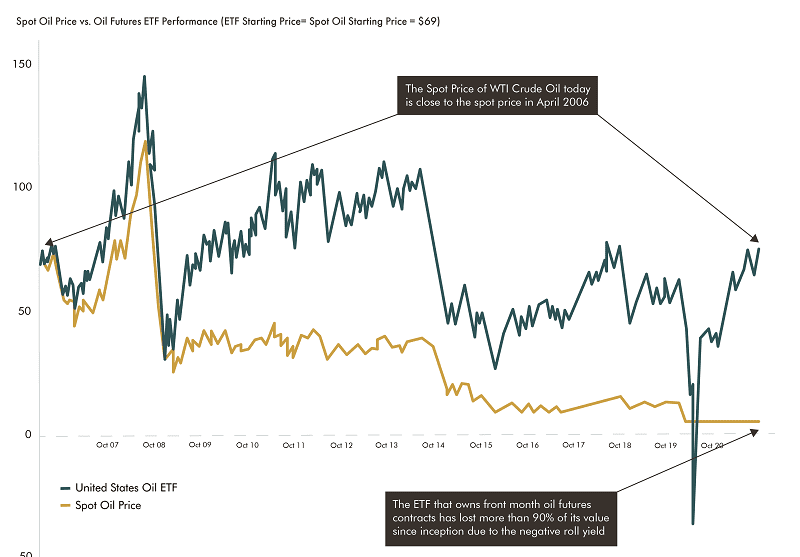

Let’s compare the growth of an investment in the largest oil futures ETF against the historical spot price of oil. The spot price of WTI crude oil today is close to the spot price in April 2006. By January 2020, the ETF that owned front month oil futures contracts lost more than 90% of its value since inception. This was primarily due to the negative roll yield.

The oil ETF employs the same basic strategy as the new Bitcoin ETF by purchasing front month futures contracts and rolling them over into next month contracts just before they expire. And, similar to the Bitcoin futures chain, the oil futures chain typically has a positive/upward slope, too.

But, the slope of the curve for Bitcoin has been substantially higher than what has been typical for oil, and we see how that turned out 15 years later.

Long story short: buyer beware.