Lessons from Financial Crises that Stand the Test of Time

Conventional wisdom went out the window, market timers missed out, and those with a plan did just fine.

In investing, there are strategies that have proven timeless and strategies that depend entirely on market dynamics and the current environment.

When we look at today’s landscape through the lens of multiple economic crises, the reality can be unsettling. While we can’t predict the story’s next twist or time the market, these collective experiences provide humbling reminders that we can learn from history.

As we reflect on 10 lessons from the Global Financial Crisis and the Great Recession that followed, we find there are time-tested tenets of investing that have endured since the dawn of modern stock market investing. They still hold true today.

No. 10: Only those willing to patiently bear the pain of down markets earn the upside potential of equity returns.

To paraphrase Theodore Roosevelt, “Nothing worth having comes easy.” In this case, the “thing worth having” is the long-term premium that investors have earned over the last century of investing in stocks.

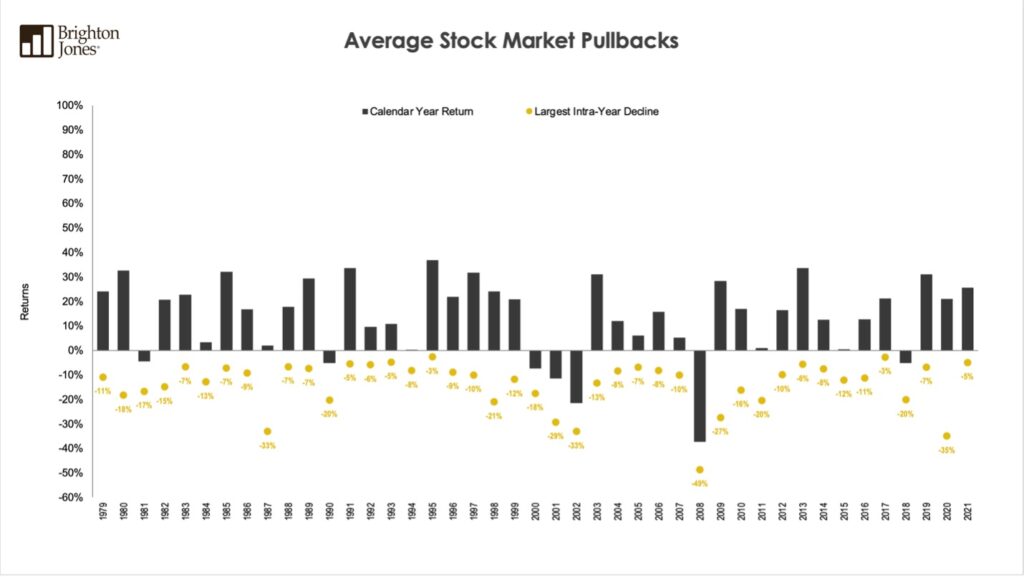

Indeed, 5% pullbacks, 10% corrections, and 20% bear markets are all just a normal part of investing in a stock market that has historically trended upward over time.

Since 1979, the average intra-year decline of the U.S. stock market has been approximately 14%. Even in years with positive returns, investors have experienced intra-year declines of 11% on average.

Why tolerate such madness? Because historically, investors are ultimately compensated for it. The long-term return of domestic equities has averaged 10% since 1926, compared to about 5% for 5-year Treasuries.

No. 9: Market timing cannot consistently and reliably outperform a buy, hold, and rebalance strategy.

The late Jack Bogle, the founder of Vanguard and creator of the first index mutual fund, stated:

“Sure, it’d be great to get out of stocks at the high and jump back in at the low. But in 55 years in the business, I not only have never met anybody who knew how to do it, I’ve never met anybody who had met anybody who knew how to do it.”

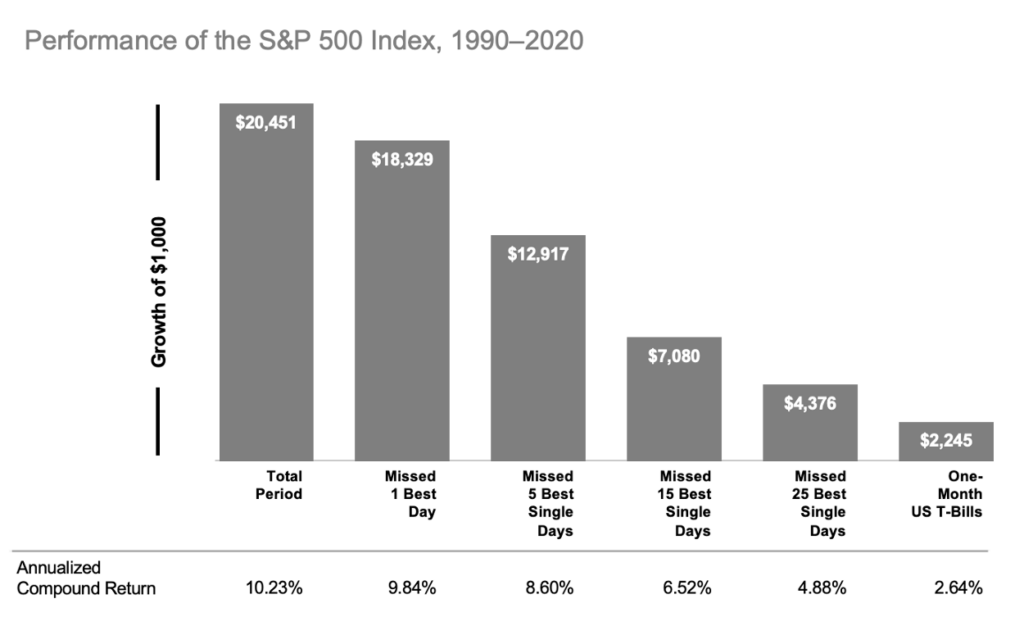

The biggest chink in the armor of market timing rests in the very nature of market moves. Missing only a handful of days can have an outsized impact on returns. The chart below illustrates the importance of remaining invested and staying disciplined through all market cycles.

No. 8: Identify your near and intermediate-term cash flow needs and insulate them from the volatility of the stock market.

If you knew you were buying a car next year, would you set aside the necessary funds in an aggressive stock mutual fund? Similarly, if you’re retired and know you’ll be spending a predefined amount from your portfolio each year, should those dollars be invested in stocks or bonds?

Many investors allocate their portfolio based on their perceived tolerance for risk, but what’s more important is to measure one’s capacity for risk. By identifying both the timing and amounts of cash flows anticipated in the near to intermediate-term, the portfolio can be constructed in a way that protects cash flows from market volatility and provides peace of mind for the investor.

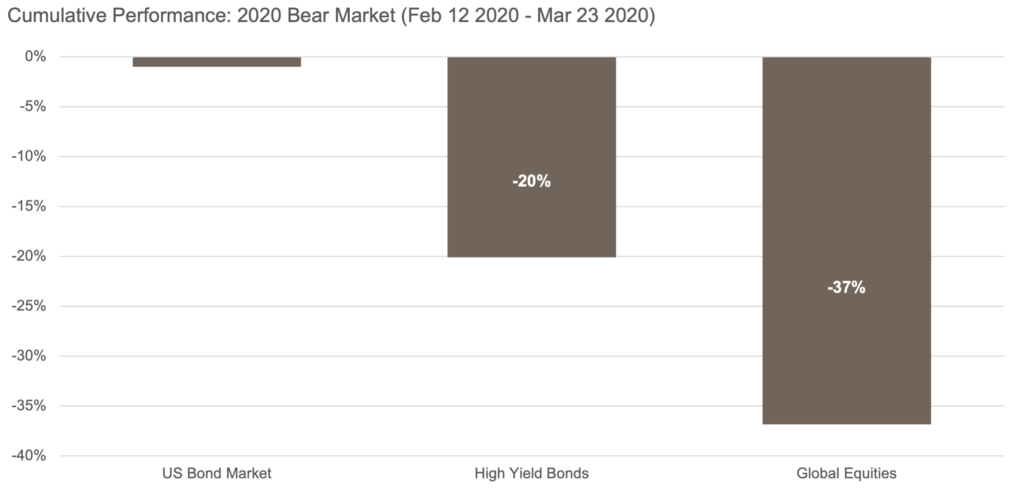

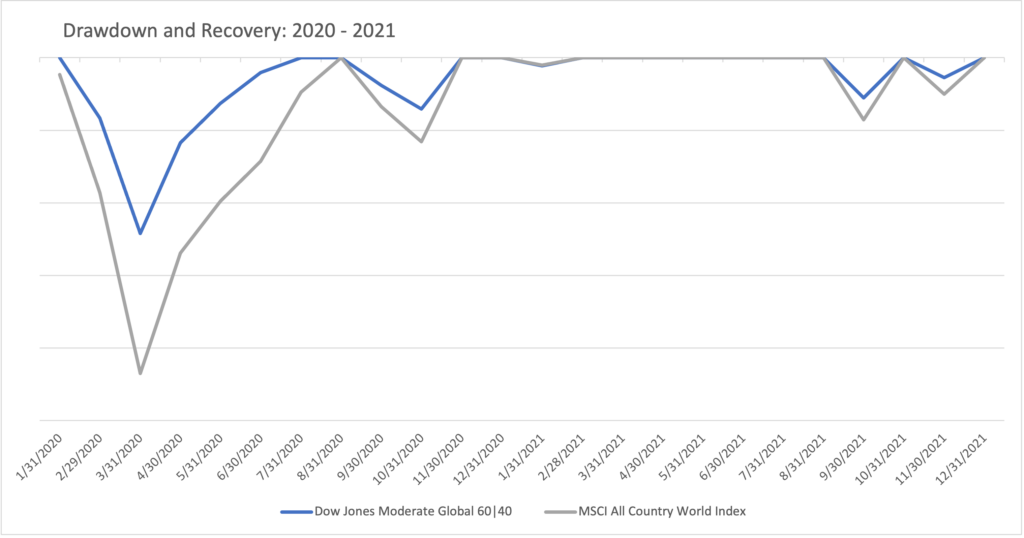

As the graph below indicates, those who invested using this framework during 2020-2021 were able to rely on the safer portions (e.g., high-quality U.S. bonds) of their portfolio for cash flow needs, allowing the equity portion of their portfolios to fully recover. Those who didn’t protect their cash flows in safe assets may have been forced to sell equities at depressed prices, creating permanent and often unrecoverable losses.

No. 7: Diversification works over time, but not necessarily all the time

Harry Markowitz, the economist and Nobel laureate, said diversification is “the only free lunch in finance.” Markowitz was referring specifically to diversifying within an asset class—this idea that instead of owning just a handful of large-cap stocks (as an example), you should own hundreds of large-cap stocks. In doing so, your expected returns aren’t adversely affected, but the risk you take is reduced dramatically. Same return with less risk—a free lunch indeed.

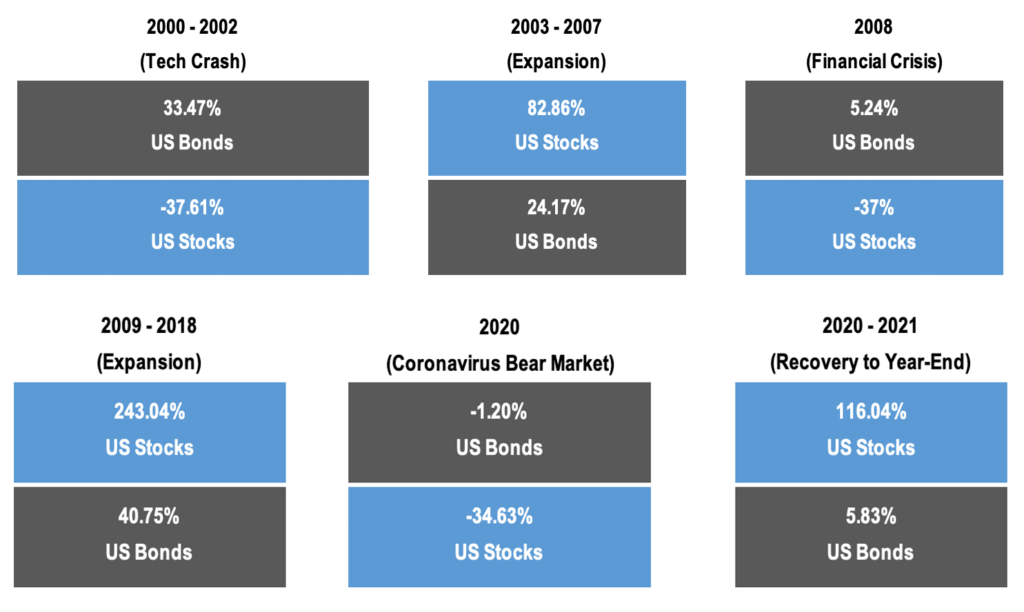

In addition to diversifying within asset classes, it’s important to diversify among asset classes. The credit crisis of 2008-2009 demonstrated how important this is. While the U.S. stock market was down 37% in 2008, U.S. Treasury bonds were actually up 5.2%. Diversifying among asset classes with different risk/return characteristics allows one to build an “all weather” allocation that can provide for cash flow needs in any market environment.

No. 6: Rebalancing allows you to systematically sell high and buy low

As Warren Buffet advised, “Be greedy when others are fearful, and fearful when others are greedy.”

What are the practical implications of this advice for investors? The first step is setting on an investment strategy that

- aligns with your goals and cash flow needs, and

- is a strategy you stick with in all market environments.

Once you’ve established strategic targets to a variety of asset classes (both stocks and bonds), monitor those targets on a periodic basis. As markets move, make incremental adjustments accordingly.

Consider what we saw during the Great Recession. As markets pulled back heavily in 2008-2009, an investor’s allocation to bonds likely became overweight (given their relative outperformance), and equities became underweight (given their significant relative underperformance). By paring back on bonds (selling high) and reinvesting into equities (buying low), you were able to follow Buffet’s advice but do so within a disciplined framework based on long-term, goals-based allocation targets.

No. 5: GDP growth expectations and investment return expectations are two very different things

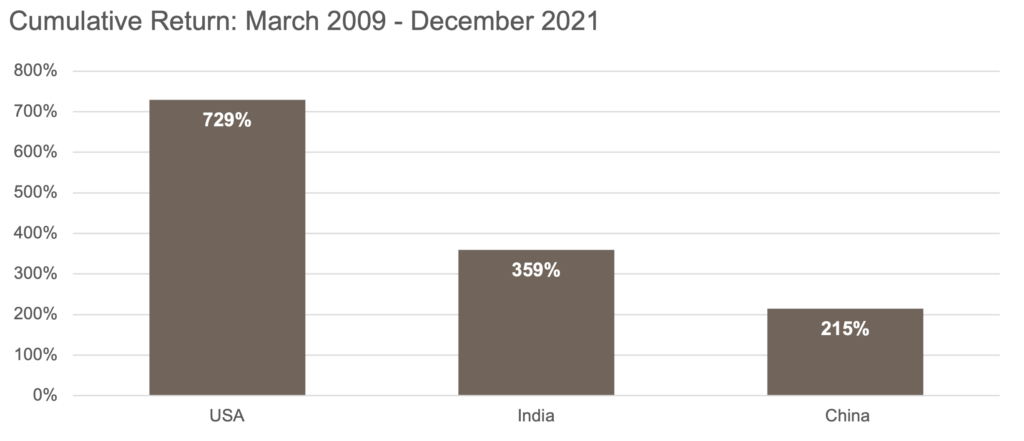

Many market commentators and analysts pointed to emerging economies such as China and India in 2008 and 2009 as the future growth engines of the global economy. Given these strong growth predictions, it was only logical that investors should allocate more dollars to these markets and expect higher investment returns.

Contrary to conventional wisdom, this wasn’t the case. As the data below illustrate, from March 2009 to December 2021, these emerging market countries significantly underperformed during this time period, even though their annualized economic growth (as measured by GDP) was significantly higher than their developed market counterparts.

Investors can’t draw a straight line from fast GDP growth and rapid stock price appreciation. Just because an economy has high GDP growth doesn’t mean that economy’s stock market will have high expected returns. The primary reason for this is that the stock prices already reflect the fact that companies reside within a rapidly growing economy.

No. 4: Rising interest rates don’t always signal negative bond and stock returns

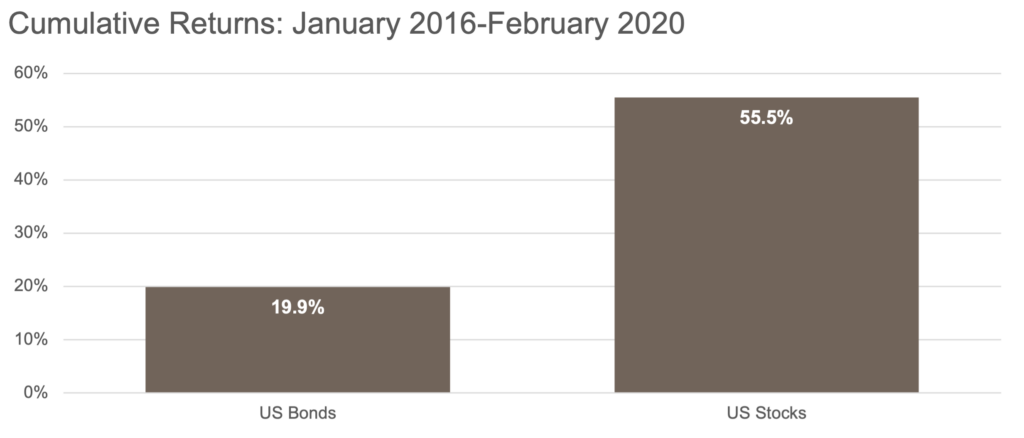

In December of 2015, after economic growth had stabilized and short-term interest rates rested effectively at 0%, the Fed raised interest rates for the first time since June 2006, in what would be the first of nine interest rate hikes.

Had an investor been told that rates would increase nine times between December 2015 and today, surely one would expect flat or perhaps negative bond and potentially equity returns given the headwind of a rising interest rate environment. But as illustrated below, this was not the case. Both bond and equity returns were decisively positive between December 2015 and February 2020.

But, when the pandemic hit, the Fed cut interest rates back to zero. Although near-term returns on bonds have been negative, we expect longer-term returns on bonds to be positive as they have been in the past, even in a rising interest rate environment.

What are we to learn from this? Conventional wisdom and market commentators are often at odds with the path that markets ultimately take. Stay centered in a long-term, goals-based approach and tune out the noise created by the financial press.

No. 3: Control what you can control

It may be cliché, but whether the market is up, down, or sideways, focus on what you can control. History provides unequivocal evidence that markets are regularly and predictably volatile.

Accept this fact, and then focus on areas that fall within your control:

- Manage Taxes: The sharp market declines a decade ago provided a golden opportunity to capture capital losses while maintaining exposure to the market. These booked losses serve as a tax asset in the future, providing an offset to future capital gains and up to $3,000 of ordinary income.

- Manage Savings Rates: If markets decline or don’t deliver the returns we all expect, we can partially offset the shortfall in returns by increasing savings rates. Although sometimes easier said than done, we ultimately can exert more control over savings rates than market returns.

- Manage Expenses: It goes without saying that saving more is easier when expenses are less (who knew?)! The first line item of your budget should be your savings target (401k, brokerage, education plans, etc.).

- Manage Investment Costs: Investing in broad asset classes is inexpensive. It rarely makes sense to pay more than 1% for an active fund manager when a passively-managed asset class can be had for 80-90% less and likely provide better returns.

No. 2: Patience and discipline ultimately win

As illustrated by the graph below, had you held a portfolio of 60% global equities and 40% intermediate-term bonds at the market peak just prior to the COVID pullback of early 2020, it would have taken you less than six months to fully recover from the punishing losses of February and March. An all-stock portfolio didn’t take much longer to recover.

In the end, a patient, disciplined, and diversified approach allows investors to withstand even the most brutal market environment and emerge relatively unscathed.

No. 1: Be wary of inflation forecasting

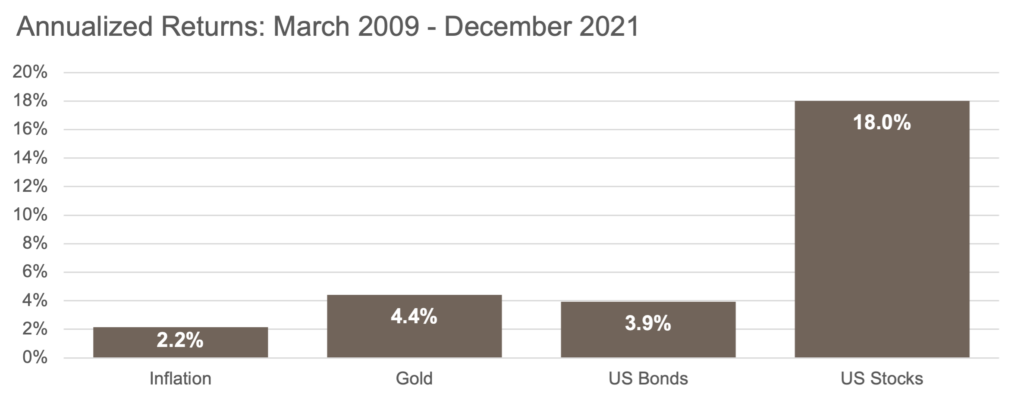

As the credit crisis unfolded and the Great Recession wore on, the Federal Reserve brought short-term interest rates to zero and engaged in additional monetary stimulus known as quantitative easing. The federal government also injected liquidity into the economy through targeted stimulus spending, using borrowed funds to do so.

Many market commentators at the time and over the intervening years suggested that this unprecedented level of stimulus spending would lead to runaway inflation. Proponents of gold touted the precious metal as the only safe refuge from the specter of soaring prices. But as indicated below, inflation remained subdued, returns on gold underwhelmed, and if anything, concerns about low inflation supplanted worries about extreme inflation.

Inflation today is real and pervasive. Stimulus spending and monetary policy accommodation during the early phase of the pandemic dwarfed what we saw during the credit crisis, creating substantial demand pressure. And, labor shortages, business closures, and production downsizes stretched supply chains. This combination creates substantially higher prices. We expect prices to normalize and these imbalances correct themselves over time.

History is a great teacher

As we reflect on our past, we realize that these lessons are variations on core themes that have served investors well for more than 90 years. And, they’ll continue to serve them well for decades to come. Although the crises we’ve endured leave a mark on American households, politics, and economic policy, the wisdom of successful investing endures.

This article was originally published on March 30, 2020, and has been updated to reflect the impact of COVID-19.