The Complete Guide to Medicare

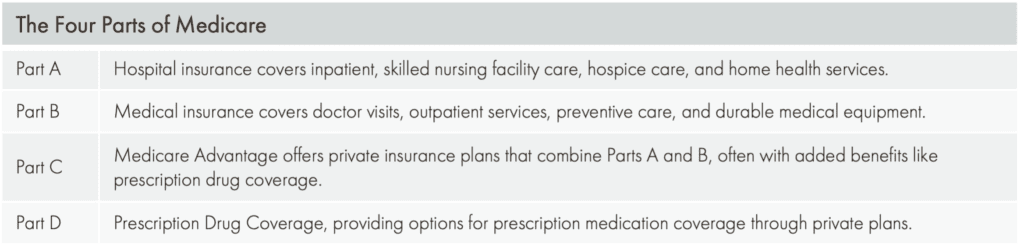

Medicare is a federal health insurance program in the United States primarily for people aged 65 and older and some younger individuals with certain disabilities. It comprises various parts (A, B, C, and D) that provide hospital care, medical services, prescription drugs, and more coverage. Our Complete Guide to Medicare covers the crucial questions our clients ask us.

Medicare Part A

Medicare Part A primarily covers inpatient hospital care, skilled nursing facilities, hospice care, and home health services. Most beneficiaries would not pay premiums for Part A if they or their spouse paid sufficient Medicare taxes while working. You are typically eligible for Medicare at 65. You may qualify earlier if you are disabled or you’ve been disabled for more than 24 months. Medicare Part A has no premium if you have worked 40 quarters (10 years) to earn that. If you have not worked your 40 quarters, there is a premium. So typically, there’s no premium for part A — which will be your hospital and skilled care benefits.

How much is Medicare Part A?

If you were to go to the hospital with just Medicare alone, there is a $1,600 ($1,632 in 2024) per hospital admission deductible. If you’re hospitalized three times a year, you’ll pay that deductible three times. If you’re in the hospital for over 60 days, you will pay $400 daily ($408 in 2024). If you’re in the hospital for over 90 days, that copayment goes up to $800 per day ($816 in 2024).

When does Medicare Part A cover skilled care?

Skilled care would be where you’ve been hospitalized, maybe following a stroke (e.g., you’re well enough to leave the hospital but not well enough to go home yet).

Skilled today is generally supposed to be acute and rehabilitative. For it to be Medicare-approved, three things have to happen: you must receive skilled care daily, show signs of improvement, and have been hospitalized for three whole days.

If you’re hitting all three of those markers, it will be Medicare-approved. They can approve up to a hundred days. The first 20 days are paid in full. From days 21 to 100, you would have a $200-a-day copayment ($204 in 2024). If you are not hitting that criteria to make it Medicare-approved, you are looking at custodial care.

So, let’s look at an example of custodial care. You’ve had a stroke, you were in the hospital for a week, you’ve gone to a skilled stay for 3 or 4 weeks. You met your 3-day hospital stay, receiving skilled care daily, and showing signs of improvement. However, around three and a half weeks, you may plateau and not get better, but you still need care regularly. In that scenario, you are transferring into custodial care. And Medicare doesn’t pay for that.

Medicare’s coverage here is intended to be acute and rehabilitative—short-term and rehabilitative stays.

READ: Should you enroll in Medicare while you are still working?

Medicare Part B

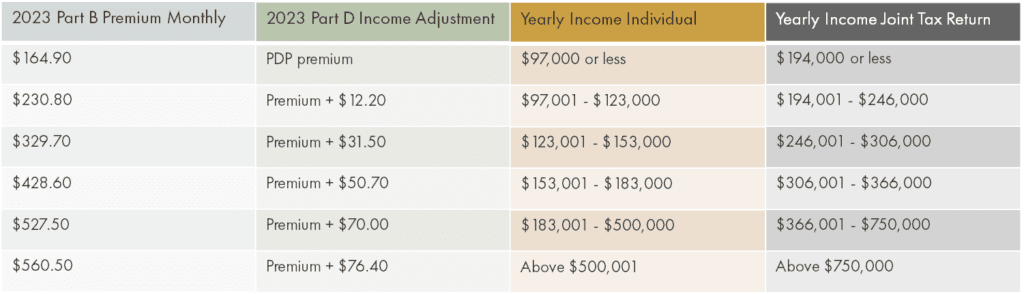

Medicare Part B is a medical benefit. The monthly premium is typically $164.90 ($174.70 in 2024), though there is a subsidy for those eligible for Medicaid. People in a higher income bracket may be hit with an income-related monthly adjusted amount (IRMAA).

What are the IRMAA brackets?

Income-related monthly adjustment amounts (IRMAA) impact those making more than $97,000 if they file individual taxes or $194,000 if they file joint taxes.

Medicare is looking at your modified adjusted gross income from 2 years ago. In 2023, Medicare is using your 2021 income to dictate your premium for the present year; come January 2,024, they will review your 2022 income.

A typical scenario involves someone working in 2021 but retiring in 2023—their income has decreased. There is room to appeal that. If you get a notice that you have an IRMAA, call Medicare to request a down adjustment to your premium.

Updated numbers come out in November—find them on the Medicare website.

Medicare is eligible to us at age 65. There is a seven-month enrollment window— an Initial Election period, IEP. You may enroll three months before, the month of, and three months after you turn 65. The effective date will be the first of your 65th birthday month. So, if your birthday is August 20, your effective date will be August 1.

Medicare Part B is your medical benefits. Think traditional major medical—doctor visits, lab work, outpatient procedures, diagnostic tests, etc.

An annual deductible is $226 ($240 in 2024). After that, you will pay 20% of all Medicare-approved services (e.g., doctors and office visits, diagnostic tests, lab work). Medicare does not cover dental, routine eye exams, or annual physicals. It also does not cover elective or alternative medicine (e.g., naturopathy, routine chiropractic, or acupuncture).

When are Medicare Special Election periods?

If you are working past 65, you may be covered by your employer’s plan. You don’t have to take out Medicare at this point. You could choose to delay Medicare in favor of your group coverage and enroll in Medicare when that group coverage ends.

It is a special election period for the loss of employer coverage if you retire when you are 67. There’s no penalty because a group plan has covered you, and you can enroll anytime.

Medicare Part D

Medicare Part D handles prescription coverage. Medicare Part D is available when you have Medicare A or B. Suppose you are somebody who has activated your A, but maybe you’re working, and you’ve delayed your part B. In that case, you want to ensure credible drug coverage because Medicare says you’re eligible for a drug plan when you’ve activated A.

The Medicare Part D program comes in 4 phases.

First, there is a deductible of $505 and then initial coverage of $4660. During this phase, we’re going to pay copayments for medications. Medicare calculates the retail cost of that drug, going towards that $4660 allowance. So, if I have a $500 medication, Medicare takes $500 every month from that $4660. If you exhaust $4660, you fall into the gap or donut hole. Costs for that medication go up to 25%. If you have been paying a $45 copayment for that drug, if you are now in the gap, you are currently paying 25%.

You will be in the catastrophic phase if you have spent $7,400 out of your pocket (excluding premiums). Drug costs drop to $4.15, $10.35, or 5% coinsurance. (We will see an improvement to this plan in 2024, with a capped maximum out-of-pocket of $8,000 on drug costs.)

All plans are going to have a formulary. A formulary is a list of drugs that that plan covers. More expensive plans may have a longer list of medications they’re hiding, and less expensive plans may have a skinnier formulary. All plans have various cost-containing provisions that they’re putting in place to try to minimize or contain costs (e.g., prior authorization, step therapy, mail order).

Medicare Options

Some people feel a little bit vulnerable with only Medicare. For ease of mind, you can do a Medicare supplement with a drug or a Medicare Advantage plan.

Medicare supplements are standardized on their letter to A through N; each letter plan will have a different combination of Medicare holes.

Plan G will fill all the holes except the Part B deductible. All plans with Part B deductible as a benefit have been closed and are unavailable to people turning 65 in 2020 or later. If you are newly 65, the most robust option will be Plan G. Hospitable deductibles, skilled care copayments, and 20% for doctor’s visits—all will be covered in a Medicare supplement. Medicare supplements work as secondary coverage to Medicare.

Medicare is the primary payer. It determines what gets paid and how much for that service; the supplement pays that copayment or coinsurance left behind.

Supplements will only pay for what Medicare approves and allows — it doesn’t cover dental. There’s no drug coverage with a supplement — you must add a separate drug plan.

One of the great things about a supplement is that there are no networks or referrals; you can go to any doctor anywhere in the country accepting Medicare; and your supplements will work.

It doesn’t matter what carrier you’re using because Medicare dictates what gets paid, where, and how much gets paid. The supplement pays what Medicare tells them to. If you want to reduce or eliminate copayments, a supplement is an excellent option for that individual.

If you haven’t activated A, you do not have to activate a D. Medicare doesn’t care what kind of drug coverage you have if you have not started Medicare A or B. If you activate A, that’s where the trigger for D comes in. If you have A in place, whether or not you have B, you want to ensure that you have credible coverage, and you’re either doing that through your employer group plan or a private Part D plan. Enrollment in Medicare isn’t mandatory at 65 if you have coverage through your current employer.

What is Medicare Advantage?

Medicare Advantage is a privatization of Medicare: Medicare is not paying your bills first. Medicare is paying the insurance company to step in and manage your healthcare. You will still pay your Medicare Part B premium. (Even if you have an IRMAA, you will pay that too.) Instead, your Medicare Part B premium will be routed to the insurance company to manage your bills. Medicare Advantage will pay for all the same things that original Medicare does. If you were going to get cataract surgery, Medicare Advantage will also pay for that. Likewise, for physical therapy, a hospital stay, or an ambulance ride. All those things will be covered under the Medicare Advantage umbrella, just like Medicare.

What’s different here is that you will start seeing copayments and coinsurances for services as we use them. If you go to the doctor, you might pay a $10 copayment to see your primary care doctor or a $45 copayment to see a specialist.

Every plan will look slightly different, specific to your zip code.

Copayments on all plans go towards a maximum out-of-pocket threshold.

You will find many extra benefits in the Medicare Advantage space. If you are over 65 or nearing 65, you probably get a lot of mail from different carriers offering a range of benefits. These are in the Medicare Advantage space. Most of these plans have benefits bundled into one plan—hospital, medical, and prescription drugs.

HMOs vs PPOs

An HMO requires you to have a primary care doctor, get referrals for specialty care, and stay within your network. If you choose an HMO and you want to see a doctor out of network, there are no out-of-network benefits unless it’s an emergency on an HMO.

PPOs do not require that you identify a primary care doctor. You can self-refer for specialty care, and you can go in-network, or you can go out of network. PPOs tend to be a little bit more expensive in either their premium or their benefit structure. But again, you want to find a plan that meets your premium or their benefit structure.

What happens to a Medicare Advantage plan if you move midyear?

A move will trigger a special election period. If you start in Seattle and move midyear to Idaho, you will be granted an option to get into the plans that are available in Idaho. Timing on the move is important. When you notify a plan that you’ve moved, they must terminate your plan at the end of that month. As a result, it may be better to wait until October 1 to notify them so you have more leeway to find a new plan in a new market.

Dates to remember

Annual enrollment: October 15 – December 7

You can change almost anything in this season. You can change drug plans, Medicare Advantage plans, or switch from Medicare supplement to a Medicare Advantage plan. Once that enrollment season ends, we can’t make any more changes. The plan will begin on January 1.

Open enrollment: January 1 – March 31

This is the “Oops!” window. You can change your Medicare Advantage plan in the first quarter if you miss the enrollment window. Or go from a Medicare Advantage plan back to Original Medicare.

However, you can’t change drug plans or go from original Medicare into an Advantage plan during this season. You can change a plan any time during the season one time. And it will become effective the following month.

Special Enrollment—any time of the year due to eligible life even change

If you’ve moved, and your plan is terminating because you’ve moved out of the service area, you’re granted a special enrollment period to get into a new plan in your new service area.

Special enrollment also applies to people who have left their group coverage. If you retire mid-year, you can get into Medicare and drug plans in the middle of the year using that special enrollment tied to my loss of group coverage.

During the enrollment period, any year from October to December, you can go from Medicare supplement to Medicare Advantage Plane—no medical questions, no pre-existing clauses.

Going from Medicare Advantage to a Medicare supplement is more nuanced based on your state. In Washington State, you can move from a Medicare Advantage plan to a Medicare supplement using United Healthcare. That is their policy. It is not a Medicare requirement. They may change that in the future, and it’s also unavailable nationwide.

FAQ

If you signed up for Medicare a few years ago, does Plan G pay for Part B?

Plan G does not cover the Part B deductible. It will cover that 20% coinsurance that Medicare leaves behind, but plan G does have a deductible on it, whatever the Part B deductible for that year.

What is Medicare coverage outside of the United States?

Medicare A and B does not travel outside of the United States.

Many Medicare Supplements have limited foreign travel benefits. The wording is that it has to happen within the first 60 days of travel. It is a $50,000 lifetime maximum with a 20% coinsurance and a $250 deductible. It’s a pretty minimal and particular benefit. And that is attached to the supplement—it’s not Medicare.

Medicare Advantage, all of those plans will say that they have worldwide emergency travel benefits.

Generally speaking, if you’re out of the country, you must pay those bills and submit them for reimbursement because they do not usually bill our insurance.

If someone turns 65 on September 5, when does Medicare insurance go into effect? Does it go into effect on September 1 or October 1?

If your birthday is any day of the month beyond the first. Medicare will start for you on the first of that month. Medicare will provide coverage the previous month if my birthday is August 1.

If you’re going to take Medicare, you can start that process up to 3 months prior. If you have an August birthday, you can enroll in Medicare in May, June, or July—and coverage will be effective August 1st.

If one spouse retires at 67 and the other is still working, is the retired spouse still covered under their working spouse plan?

As long as a group plan covers you, it doesn’t matter if it’s your or your spouse’s plan—delaying your Part B or Medicare is acceptable.

Alternatively, you and your spouse are covered on their plan as the coverage is better. If your spouse retires and you move to your group plan, you can still delay Medicare because a group plan is still covering you. It doesn’t matter that it was your partner’s plan, but now it’s yours—there is still group plan coverage. It’s acceptable to delay Medicare without penalty.