Three Retirement Planning Strategies for Young Adults

Saving Now Pays Later

The majority of employers offer sponsored retirement plans- typically a 401(k) or a 403(b). When a new employee signs up for the plan they are commonly faced with three important choices:

1. Roth vs. Traditional Retirement Plan

Employees can often elect to make post-tax contributions to a Roth, or pre-tax contributions to a Traditional plan. The primary driving factor for this decision is how your marginal tax rate now compares with your expected tax rate in retirement. If your marginal tax rate in retirement is below your tax rate while working, then the traditional option is the way to go. If not, the Roth makes sense. Although it is difficult to predict future tax rates, for most recent graduates in entry-level roles, the Roth provides a good opportunity to begin creating a nest egg positioned for long-term tax-free growth.

2. Investment Allocation

Because of the long-term nature of the money in your retirement account, it makes sense to aggressively allocate these dollars to assets with high expected returns. Typically, this will mean placing the majority of the account in funds that own U.S. and Foreign equities. Most retirement plans offer a list of predetermined mutual funds as investment choices. It is important to consider both diversification and cost when making investment elections. When investing in equities, for example, we advocate broad sector and market cap exposure. Equally important is the fund’s expense ratio. High expenses will negatively impact long-term performance, so it is advantageous to construct an allocation using relatively low-expense funds.

3. Contribution Amount

Many employers offer to match employees’ retirement plan contributions up to a specific percentage of their salary on an annual basis. Clearly, this can be a significant benefit. At a minimum, it makes sense to contribute enough to take full advantage of the employer match.

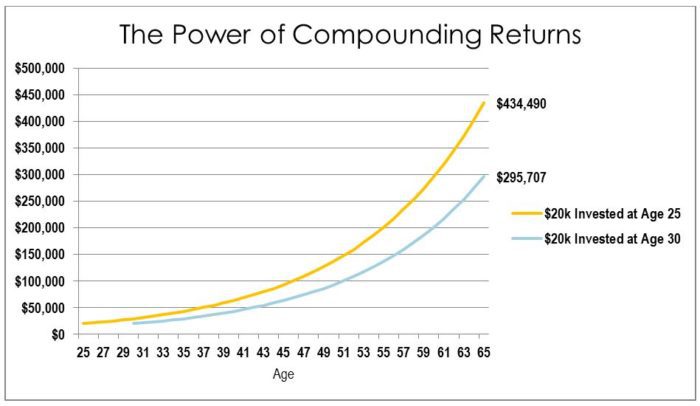

As a young, newly employed graduate, it may be tempting to contribute a minimal amount to your retirement plan in exchange for additional disposable income. It is important to remember, however, the power of compounding returns over significant periods of time. A dollar saved today will be worth significantly more at retirement than a dollar saved even 5 years later. The graphic below (click to enlarge) shows the growth of $20,000 invested at age twenty-five vs. five years later at age 30, assuming an 8% average annual return.

The extra five years of compounded annual growth result in an additional $138,700 at age 65. This represents a 47% premium! Assuming these dollars were invested in a Roth, this exponential growth would also be tax-free. Saving early in life can have powerful implications. As a young person, it is important to recognize that you are in a unique position to set yourself up for long-term financial strength.