Investors Turn Anxious After Federal Reserve Comments

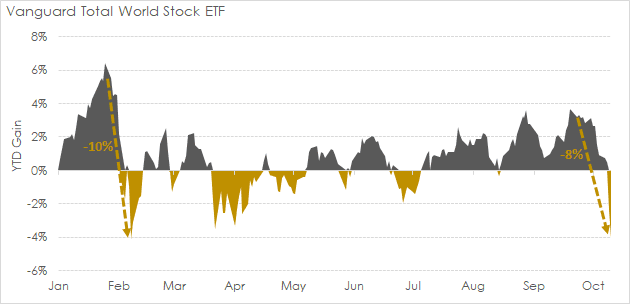

Since September 20, global equity markets have pulled back approximately 8 percent, with much of the downside volatility occurring in the past six trading days. The chart below illustrates year-to-date performance of the Vanguard Total World Stock Market Index ETF, representing market capitalization weightings of domestic, foreign developed, and emerging market stocks.

As shown, global equities recently swung from a ~4 percent year-to-date gain to a ~4 percent year-to-date loss. In our view, the primary catalyst behind the selloff was recent commentary by Federal Reserve officials.

A More Optimistic View of the Federal Reserve

Recent commentary from Federal Reserve Chairman Jerome Powell (pictured below) and New York Fed President John Williams has suggested a more optimistic view of the economy relative to the prevailing market consensus. Specifically, Chairman Powell noted that “There’s really no reason to think that this cycle can’t continue for quite some time,” adding that “Interest rates are still accommodative, but we’re gradually moving to a place where they’ll be neutral. We may go past neutral. But we’re a long way from neutral at this point, probably.”

In response, interest rates spiked as investors discounted the possibility that the Federal Reserve would raise interest rates higher than previously anticipated. In turn, the possibility of higher interest rates has put downward pressure on both fixed income and equity securities.

Why Would Markets Sell Off If the Fed Is Optimistic?

Economic and earnings growth has been exceptionally strong this year (especially during the second quarter). However, some fear this was the result of a sugar high from the tax bill and fiscal spending, the benefits of which may dissipate over the next few quarters. After a ~20 percent increase in earnings growth this year, consensus expectations are for 2019 S&P 500 earnings growth to moderate to below 10 percent. Against this backdrop, investors have become worried that perhaps the Fed is overly optimistic and may get ahead of the curve on interest rate hikes.

Guidance

In terms of investment strategy, we are not recommending any portfolio adjustments at this time.

For those who are concerned about near-term volatility, you can rest easy knowing that your portfolio allocation is structured around your anticipated cash needs. That is, monies needed to fund obligations in the near-term are protected in cash and short-term high-quality bonds (i.e. not exposed to the extreme volatility of equity markets), while the portion of your assets invested in global equity markets has a time horizon of 15-plus years.

For those who might be looking at today’s decline as a buying opportunity, we urge caution and would prefer to wait. An 8 percent pullback is relatively shallow by historical measures. Only after a more pronounced pullback would we potentially look to take advantage of this development.

We will continue to monitor this situation and provide updates as it unfolds. In the meantime, please do not hesitate to contact your planning team with any questions.

Data sourced from Brighton Jones and Yahoo Finance | Photo credit: Bipartisan Policy Center

Read more from our blog: