How are RSUs Taxed?

In the scramble to understand a vesting schedule, some people lose track of how RSUs are taxed and the implications on their total compensation. Some sectors, like tech, heavily weight total executive compensation with RSUs, and with it comes some tax liabilities you may not have planned for.

Understanding RSUs and their tax treatment

Restricted Stock Units are company shares given to employees as compensation but come with restrictions and vesting criteria. Unlike stock options, RSUs are taxed as income upon vesting, not when granted. This means the value of the shares, when vested, is considered supplemental income and is taxed at your ordinary income tax rates. Many of our executive clients who are granted RSUs run into this scenario, where their W-2 will represent additional ordinary income from the options vesting but with no correlating cash received. It’s crucial to plan proactively and carefully for this discrepancy.

Tax implications at vesting

When RSUs vest, the total value of the shares becomes taxable income. For high-income earners, this could push you into a higher tax bracket, substantially increasing your tax burden. The shares are subject to federal, state, and sometimes local taxes, as well as Social Security and Medicare. There are two key elements to taxation: the ordinary income recognized upon vesting and the gain upon the actual sale of the shares at the recipient’s discretion.

Let’s look at an example. Consider a tech executive whose annual salary is $250,000. Suppose she receives 1,000 RSUs vesting when the stock is priced at $100 per share. In that case, the vesting adds $100,000 to her taxable income, potentially pushing her into a higher tax bracket and increasing their overall tax liability. Important to note is that the tech executive will not receive $100,000 in cash but will pay tax on this amount.

Strategies to optimize taxes on RSUs

Timing the sale of RSUs

After your RSUs vest and the shares are deposited into your account, you have control over when to sell the shares. Selling immediately after they vest minimizes the risk of paying higher taxes on potential gains if the stock price increases. Conversely, holding the shares could lead to capital gains tax if sold after a year, which might be lower than your income tax rate if you anticipate being in a lower tax bracket upon retirement. If an individual can absorb the tax hit upon vesting without needing to sell shares, holding for a year or more can provide capital gains savings of over 20%. As we work with our clients surrounding RSU taxation and planning, creating a vesting schedule and a cash-flow plan is one of the first steps to help clarify how to maximize tax efficiencies.

Charitable contributions

Donating some of the stock to charity after it vests but before selling can provide a charitable tax deduction at the fair market value of the donated shares, reducing your taxable income. The contribution of appreciated stocks allows for power tax planning opportunities.

Deferred compensation plans

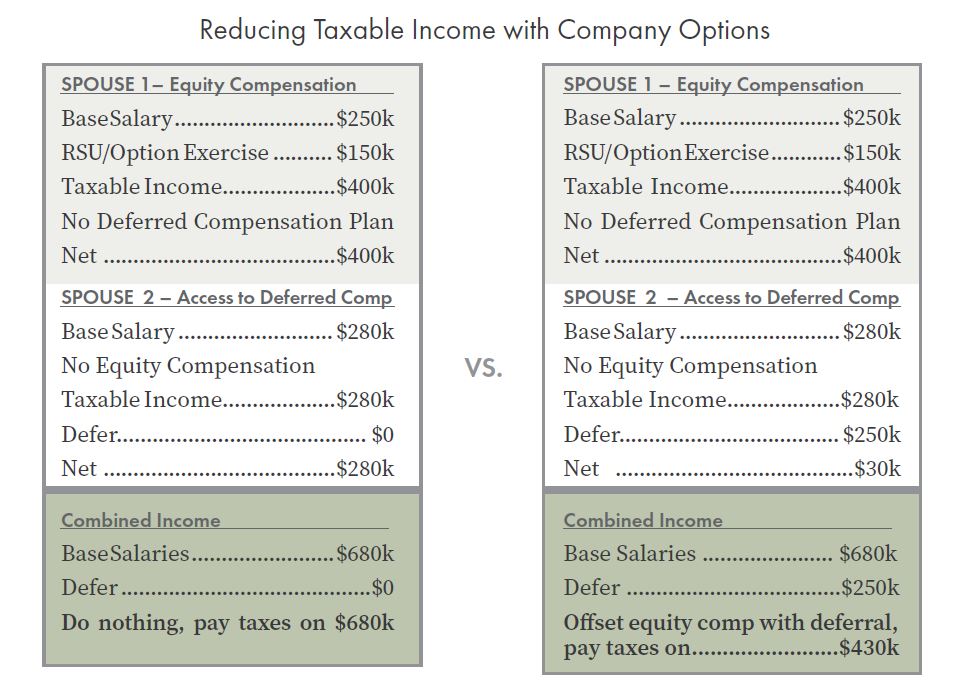

Participating in a deferred compensation plan allows you to defer receiving part of your income until later, potentially lowering your current tax bracket and deferring taxes on that income.

One common approach is to defer the anticipated proceedings from exercised stock options. In the example below, a couple reduced their taxable income by the amount of income they anticipated receiving from RSU vesting proceeds, effectively reducing their taxable income to $430K rather than $680K (see below).

Utilizing professional advice

Considering the complexities associated with RSU taxation and vesting schedules, consulting with a tax professional or financial advisor is highly recommended. For high earners receiving RSUs, the key to managing your finances effectively is understanding how these stock units are taxed and planning accordingly.

Staying proactive about your tax planning and seeking professional guidance can significantly affect your financial health and long-term wealth accumulation.