Separate Fact From Opinion in the Investing World

All of the world’s most successful investors have one thing in common…

Successful investors adhere to a set of beliefs and principles that guide their decision-making process. They each have a clearly defined and well-articulated investment philosophy that describes how they seek to capture investment returns.

This is not to say all successful investors adhere to the same set of principles, however. Indeed, it is not uncommon for two investors with equally impressive track records to employ completely different investment styles that seemingly contradict one another.

Because history shows that different investors find success employing different investment styles, however, it can be difficult to separate fact from opinion in the realm of investing.

For this reason, we’ve compiled an unbiased list of truths for those seeking a better understanding of how capital markets work.

Investment Truths – #1: Capitalism Creates Wealth

Capitalism creates wealth when natural resources, labor, intellectual capital, and financial capital combine to produce economic growth.

Individuals are entitled to a share of that economic growth when their financial assets are invested and used by the global economy.

Successful investing does not require picking the right stocks or predicting opportune times to move in and out of the market.

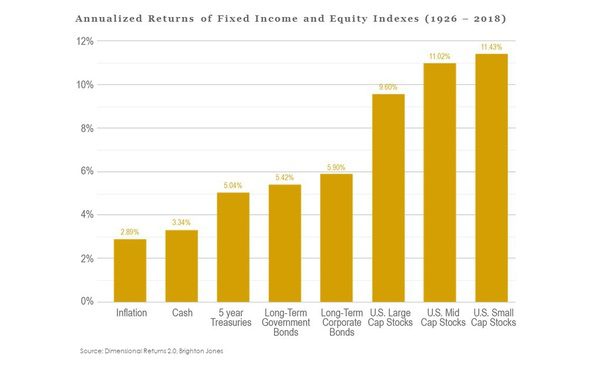

Individuals can acquire and benefit from an ownership stake in capitalism by retaining broad exposure to capital markets, a strategy that has historically rewarded fixed income investors with about a 5 percent annualized rate of return and U.S. equity investors with nearly a 10 percent annualized rate of return.

Download the white paper to view the full list of Investment Truths:

14 Truths for Investing in Today’s Market