The Best Response to Market Turmoil? Taking Proactive Steps Long Before It Hits

Stock market volatility has flared up once again, keeping investors on edge and attentive to news headlines for cues of what’s to come. Over the past three trading sessions, global equity markets have declined approximately 5 percent in value.

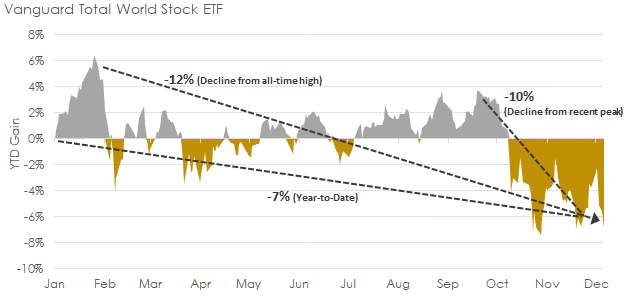

For perspective on where things stand after the wild performance swings, the chart below illustrates year-to-date performance of the Vanguard Total World Stock Market Index ETF, representing market capitalization weightings of domestic, foreign developed, and emerging market stocks.

As shown, global equities have declined in value by 7 percent since the start of the year, and 12 percent since reaching their all-time high in January. Quarter-to-date, performance has been volatile in both directions, with repeated pullbacks followed by sharp rallies.

How We’re Responding to Recent Market Volatility

Whenever equity markets are in the midst of a pullback, individual investors are often advised to “Stay the course” by experts. This is good advice—investors should not change a strategy they put in place during rational times when an unfavorable outcome they knew was inevitable (i.e. a market decline) eventually comes to pass. Indeed, we similarly advise our clients to “stay the course” when equity market performance turns negative.

While advising clients to stay the course has the potential to come across as dismissive of prevailing or potential risks, we remain confident in giving this advice because of the steps we have already taken to prepare our clients and their portfolios. While we are often asked, “How is Brighton Jones responding to recent market volatility?”, it is perhaps more informative to review what we have done leading up to this point.

When we look at the driving factors behind recent volatility, we believe the adjustments we already made to our strategic allocation framework have appropriately positioned us moving forward.

Recent Investment Model Changes

- In July 2017, we introduced revisions to our investment model that reduced our equity exposure by 5 percent. In a letter to clients, we cited elevated equity valuations (and the potential for rising interest rates to put pressure on valuations) as the primary reason for the adjustment.

- In August 2018, we introduced revisions to our investment model that shifted the make-up of our fixed income holdings. Specifically, we reduced our exposure to intermediate-term investment-grade bonds and increased our exposure to floating rate bonds, inflation-protected bonds, private credit, and higher-yielding bond categories. In a letter to clients, we cited Federal Reserve interest rate policy and the potential for inflationary pressures as the primary reason for the adjustment.

- When we look at the driving factors behind recent market volatility (re-rating of interest rate expectations and fears of tariff-induced inflation), we believe the adjustments we already made to our strategic allocation framework over the past 17 months have appropriately positioned us and that further adjustments are not warranted.

Ongoing Rebalancing

- Rebalancing is the process of realigning the weightings of portfolio holdings as performance across market segments diverge over time. In the context of a broadly diversified investment portfolio, rebalancing typically involves taking profit from positions with the strongest performance and replenishing exposure to positions that performed more modestly.

- While it might not seem intuitive or logical to take profit from the best performers, especially if they continue to perform well, it can prove beneficial both emotionally and financially to have done so over a full market cycle. As the saying goes, it is better to rebalance your portfolio before the market rebalances for you!

- As global stock markets have produced double-digit percentage gains over the past ten years, we have methodically redistributed profit from our equity positions to less volatile market segments (as the weightings of our holdings drifted from their targets). As noted, rebalancing can detract from returns when high performing market segments continue to produce strong returns, but rebalancing eventually proves its merits when the tide turns.

While it might seem counterintuitive to take profit from the best performers, it can prove beneficial both emotionally and financially to have done so over a full market cycle.

Aligning Client Allocations With Their Cash Needs

- It goes without saying that investors generally prefer high returns to low returns. But, the key to assuming risk responsibly in pursuit of higher returns is to give each asset class an adequate amount of time to achieve its long-term expected rate of return. This is why we set allocations based on the timing and amounts of each client’s anticipated cash needs.

- We protect the first 8 years of anticipated cash needs in a Capital Preservation Portfolio, and the next 6 years in a High Income Portfolio—which buys us a 15+ year time horizon on monies allocated to Global Equity.

- In cases where our clients do not have any anticipated cash needs for the foreseeable future, our model calls for a minimum allocation of 10 percent to Capital Preservation and 20 percent to High Income—meaning that our most aggressive portfolio currently has 30 percent allocated to fixed income securities (as noted under Recent Investment Model Changes, this has not always been the case). For comparison, aggressively allocated target date retirement funds will typically allocate 10 percent to fixed income and 90 percent to equities.

Conclusion

During periods of heightened equity market volatility, financial experts often quip, “Don’t just do something, stand there!” To some, this advice may come across as dismissive of prevailing or potential risks. But, in our case, we are confident advising our clients to stay the course because (1) we have already made the necessary adjustments to our investment model over the past 17 months, and (2) we have a proven process for effectively managing client portfolios through periods of heightened volatility.

We will continue to monitor this situation and provide updates as it unfolds. In the meantime, please do not hesitate to contact your planning team with any questions.

Data sourced from Brighton Jones and Yahoo Finance

Read more from our blog: