The Overlooked Factor in Bond Returns

One of the more common questions we hear from clients is, “Why are my bond funds losing money?”

In most cases, especially when we’ve held the positions in question for several years, the strategies haven’t actually lost money. In fact, they may have provided a significantly positive total return—that is, when accounting for income received and reinvested.

A person may conclude that their bond funds have lost money—and should therefore be sold—after logging into their custodian’s website and noticing one or more positions with unrealized capital losses i.e. the cost basis is higher than the current value.

The Equation’s Missing Factor

Comparing cost basis to current value is not indicative of total return. What’s missing from the equation is the interest earned on the initial purchase as well as interest earned on reinvested income. This relationship will be more noticeable when yields are rising, and bond fund income payments increase as a result. Over time, interest income and reinvestment will account for the largest portion of total return in bond funds.

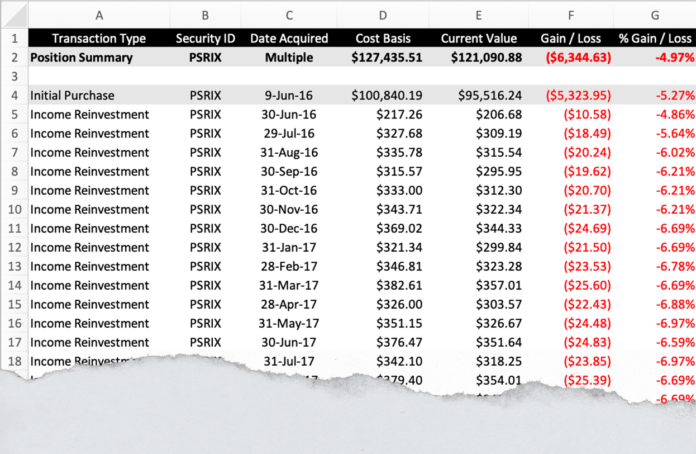

The table below is a typical example of what a client might see through their custodian. The first line of the table shows the position level summary. The position has a current value of $121,090; and because the cost basis is $127,435, there is an unrealized loss of $6,344.

As you scroll through the individual tax lots, you will see that there was only one buy order placed in the history of the position in the amount of $100,840. The reason the cost basis shows as $127,435 is because all the reinvested income payments get added to the initial purchase cost. From a total return standpoint, only $100,840 was purchased, but you now have $121,090. So, the total return is a positive $20,250.

If this were held in a taxable account, you could harvest the unrealized capital loss even though you have a positive total return.

This same fact pattern holds true for any income-paying investment, including equities. But, the impact is more pronounced for investments with a higher ratio of income to capital appreciation. In other words, it works the same way for global equity positions, but most people don’t notice when there is an overall gain. And, as mentioned above, the longer the position has been held the greater the discrepancy.

This isn’t to say that bond positions are never negative, especially in the short term. It’s important to be aware that this is often the culprit when someone is concerned about bond fund losses.