Is a Personal CFO Right for You?

Brighton Jones helped pioneer the Personal CFO approach to wealth management nearly two decades ago.

As Personal CFOs, we work with clients to see the big picture—their total balance sheet and how everything works together. We also painstakingly catalog and analyze every detail, understanding how each component fits into the broader, holistic plan. As fiduciaries for our clients, we have a legal obligation to act in their best interest, and we believe the best way to fulfill this obligation is to serve as a Personal CFO and embrace a truly comprehensive wealth management approach.

What exactly is a Personal CFO, and is it the right fit for you?

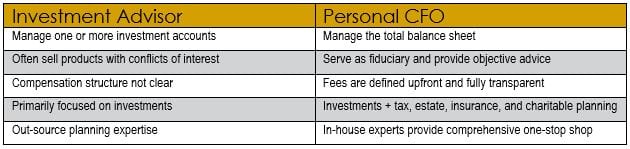

The comparison below highlights some of the differences between a more traditional investment advisor and a Personal CFO.

What are the practical implications of working with a Personal CFO?

Consider the following examples of how a Personal CFO might contrast with a more traditional advisor:

- We will take time to listen to your goals and build an understanding of your cash flow (income, expenses, saving, etc.) to better inform your asset allocation and the long-term sustainability of your plan.

- After obtaining your insurance documents (home, auto, liability, long-term care, disability, life, etc. as applicable), we will vet providers, analyze policies, map coverages, and offer support on any open claims.

- We will evaluate your key estate planning documents (wills, trusts, powers of attorney, health care directives, etc.) in a holistic manner and act to ensure your plan appropriately and efficiently carries out your wishes.

- We will catalog and analyze your company benefits, including any company equity you may have (options, restricted stock, etc. as applicable), and incorporate these benefits into your overall portfolio and allocation.

- We will assess your current education accounts (as applicable) and determine if the investments are properly diversified and efficient, and the current funding level is appropriate based on your objectives.

This is just a short sampling, but hopefully these examples give you a sense for how a Personal CFO engages more deeply with clients on a broader array of issues than a more traditional investments-focused advisor. Although hiring a Personal CFO might not be the right fit for everyone, for those who see the benefit of a more integrated approach, we believe it has tremendous power to improve client outcomes and ultimately help our clients live a richer life.

Read more from our blog: