Revisiting Your Portfolio Strategy As Bear Market Looms

With global equity markets approaching bear market territory, defined as a peak to trough decline of 20 percent or more, many investors may be wondering if they (or their advisor) could have done something to anticipate such a setback.

2020 Market Volatility

- 10 Lessons From the Financial Crisis That Stand the Test of Time

- Timeless Investment Truths in Uncertain Times

- The Market Is Down. What Should You Do?

The Fallacy of Market Timing

For a moment, many of us may find ourselves daydreaming about the financial gain we could have reaped if only we had liquidated our equity exposure as stock prices peaked, providing us with an opportunity to reinvest as markets eventually bottom out. But, sooner or later, we wake up and remind ourselves of the unsatisfying truth we knew all along: the future is unpredictable, and anyone’s prognostications are too unreliable to act upon.

Why is that? To avoid losses and earn outsized profit from successfully timing stock market gyrations, an investor must be able to (1) identify the catalysts that drive shifts in momentum, (2) pinpoint the timing of directional changes, and (3) forecast the magnitude of upward and downward price movements. Being off on any one of these conditions can leave a market timer worse off than making no moves at all. And, getting them right consistently over one’s lifetime is a feat nobody known to us has achieved, despite the occasional one-hit-wonder.

So, what’s an investor to do? We have always approached stock market volatility in the same way we approach severe weather events or other natural disasters. That is, we may not be able to predict when a catastrophic hurricane will break landfall, but we do know which geographies are susceptible to hurricanes and how to build shelters that will stand up to high winds and flying debris. The same goes for earthquakes, floods, and the like.

Similarly, we may not be able to predict when a recession, pandemic, war, inflation shock, etc. will change the investment landscape. Still, we do know which market segments are likely to suffer most from these types of events and how to construct portfolios in a way that limits the possibility of irreversible financial loss.

What History Tells Us About Portfolio Construction

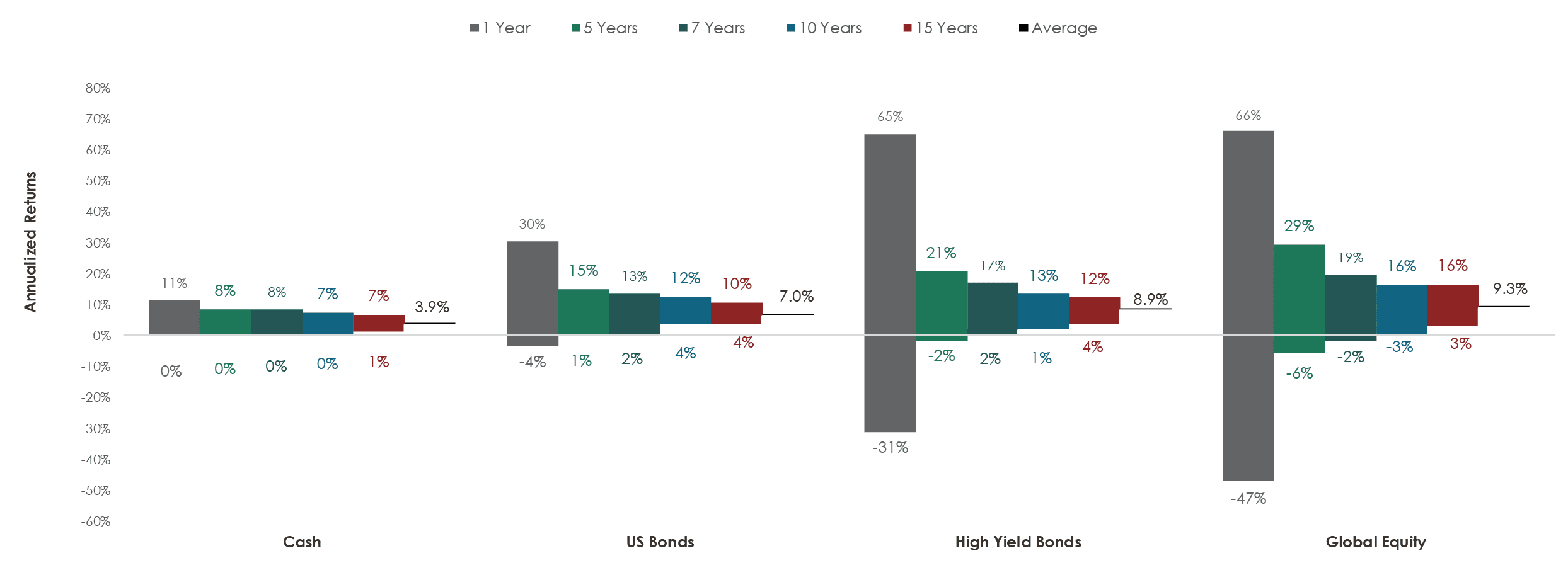

Our portfolio construction process begins with a series of observations about the behavior of different asset types throughout history. In analyzing the historical range of annualized returns for cash, bonds, and stocks over holding periods ranging from 1 to 15 years, we observe that (1) asset classes with higher expected returns experience a wider distribution of outcomes, (2) asset classes with the widest distribution of outcomes require longer holding periods to mitigate the potential for loss, and (3) time acts as a force of gravity, of sorts, through which annualized returns for each asset class are drawn towards their long-term average.

Range of Holding Period Returns by Asset Class (1983 – 2019)

With the belief that the key to assuming risk responsibly in pursuit of higher returns is to give each asset class an adequate amount of time to achieve its long-term expected rate of return, we customize each clients’ asset allocation based on the timing and amounts of their anticipated cash needs.

Specifically, we endeavor to protect the first eight years of anticipated cash needs in cash and high-quality bonds, and the next six years in higher-yielding fixed-income securities—which buys us a 15+ year time horizon on monies allocated to global equity markets (note: some client allocations might deviate from these numbers based on unique circumstances or conversations with your planning team).

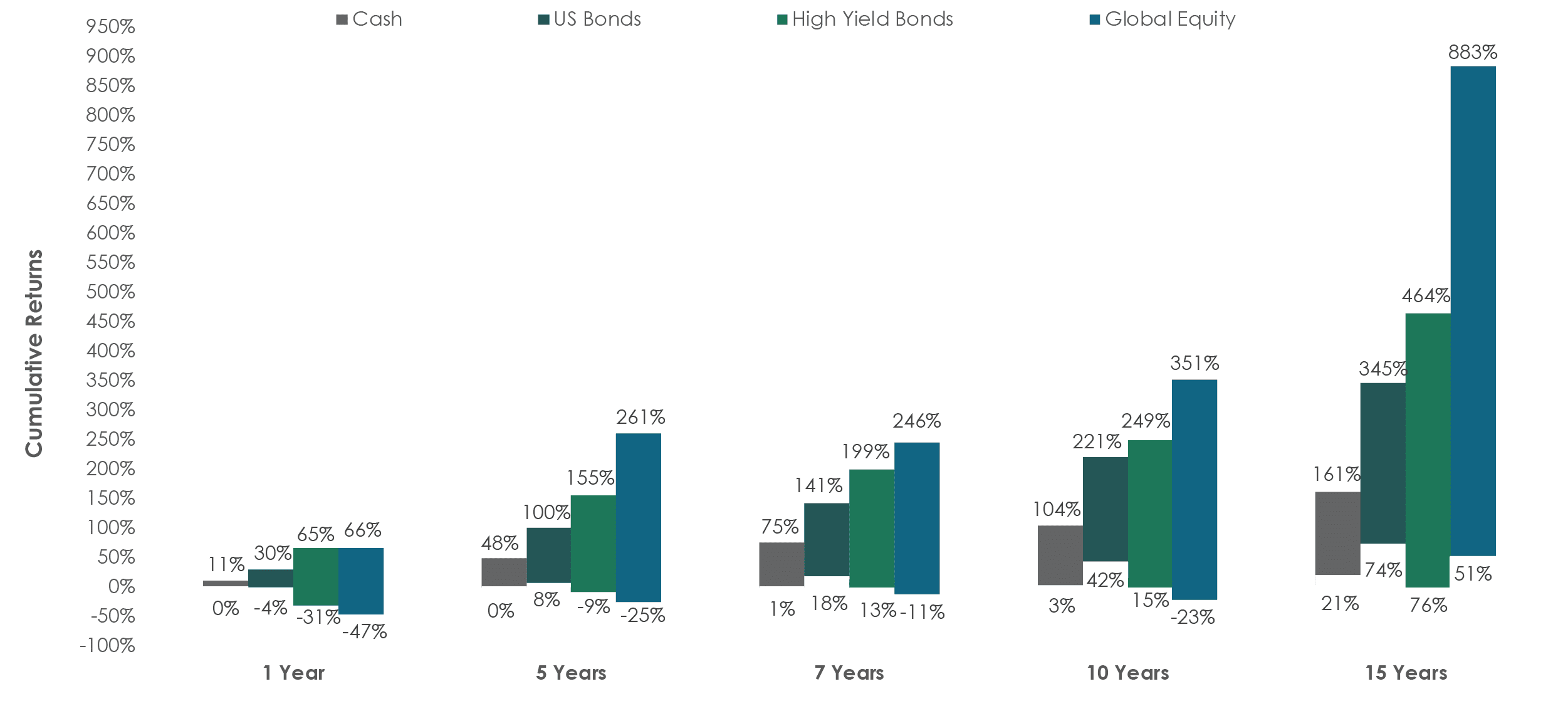

In analyzing the range of cumulative asset class returns for holding periods ranging from one to 15 years, we remain confident the time horizons we have set for each market segment strike the appropriate balance between protection for near-term cash needs and high growth potential for long-term assets.

Cumulative Asset Class Returns by Holding Period (1983 – 2019)

Going back to our earlier analogy: in a perfect world, it would be ideal to predict the arrival of a catastrophic event, thereby allowing people to evacuate and avoid it altogether. But in such cases where we cannot predict the arrival of a catastrophic event (e.g., an earthquake), it becomes necessary to focus our efforts on a second type of prediction: an understanding of what it will take to survive it.

Preparation Over Prediction

The same lessons we can learn from disaster preparedness apply to investors: we know that shocks, crises, and pullbacks are inevitable—and we know they will be unpredictable in their timing—but with prudent portfolio construction and a long-term perspective, we are confident that outcomes for our clients will be favorable.

As always, we will continue to monitor the investment landscape and provide updates as the future unfolds. In the meantime, please do not hesitate to contact your planning team with any questions.

Read more from our blog: