Allocating Your 401(k) Retirement Dollars: What’s the Right Approach for You?

Do you have a DIY mindset? Or do you want more control over your retirement asset allocation?

If you’re lucky enough to work for a company that offers a retirement savings plan, you’ve probably encountered the issue of selecting the appropriate funds in which to allocate your hard-earned money.

I like to think of a retirement plan like a buffet-style restaurant. There are a wide variety of options, but identifying what direction is right for you is the toughest part. Which option makes the most sense and why?

The decision lies in who you are as a person. When we’re making any decision, it usually comes down to three important considerations:

- Time: Do you want to invest the time in learning how this works?

- Desire: Is this something you enjoy doing? Would you rather spend your time on something else?

- Expertise: Do you know how this works? Are you confident in your decision?

The goal of this article is to help you hone your decision-making capabilities when it comes to investing your retirement plan dollars.

Retirement plans typically offer a few different ways for you to invest your money: individual funds and target-date allocation funds. If you feel savvy enough to select individual funds, you’ll first want to identify your time-horizon for retirement.

When examining the differences between individual funds and target date funds, keep in mind that there is never a right or wrong, simply pros and cons.

Individual Funds

First and foremost, consider how involved you’d like to be in the management of your account.

If you’re the type of person who watches the market and pays attention to your investment portfolio, you might enjoy selecting the mix of investments that make up your retirement asset allocation. However, if you’d rather watch paint dry than keep a vigilant eye on financial markets, selecting individual funds might not be the best course of action.

With individual funds, take time to familiarize yourself with the characteristics of each investment available to you. Countless questions will come to mind, including the differences between stocks and bonds, your comfort level with market volatility, and how to allocate your money across multiple funds. If answers to such questions come easy to you, you might feel prepared to select the appropriate mix of investments. However, once you set your asset allocation, you have to consistently monitor and rebalance your portfolio to adjust for prevailing market conditions.

This is where time-horizon comes into play. Knowing how and when to adjust your retirement asset allocation can be complicated and subjective, depending on what the talking heads on TV are saying. It’s easy to be influenced by breaking news or sudden market movement, but you have to be able to stomach your emotions.

At the end of the day, if you have the financial acumen to make appropriate choices, it can be fun to have the flexibility to pick and choose where your retirement dollars go. However, if you’re truly a “set it and forget it” type of investor, it just might not be the best choice for you.

Target Date Funds

Target date funds are perfect for those individuals who want to make sure they are getting a fair dose of diversification but who don’t want the pressure of having to adjust the percentages in each investment over time. With target date funds, the very first step is to think about what year you’d like to step away from work and start utilizing your retirement dollars.

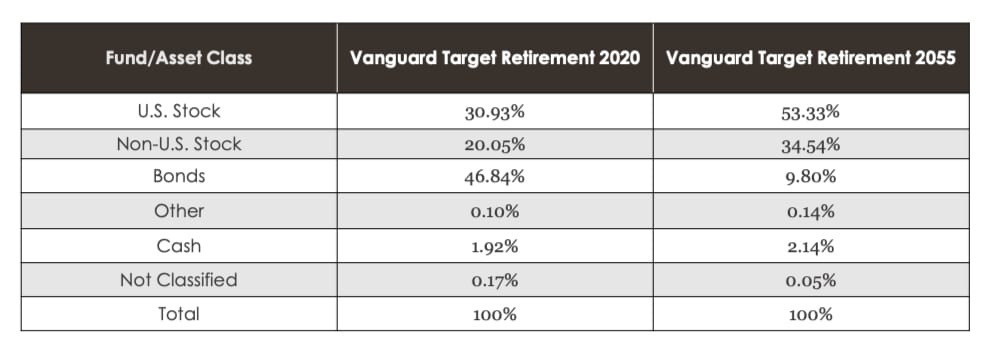

Let’s take a 31-year-old individual who works until age 67 in 2055. Now that you’ve identified a year, you can select the fund that matches that time horizon. Digging into the available funds, we see that the allocation gradually becomes more conservative as we inch closer to 2055. To show this in real life, I’ve compared the Vanguard Target Retirement 2055 fund with the Vanguard Target Retirement 2020 fund:

As you can see, the 2020 fund is heavily weighted toward bonds (47 percent versus 10 percent). That’s because you don’t want to expose your hard-earned savings to a potentially volatile stock market in the last few years before retirement.

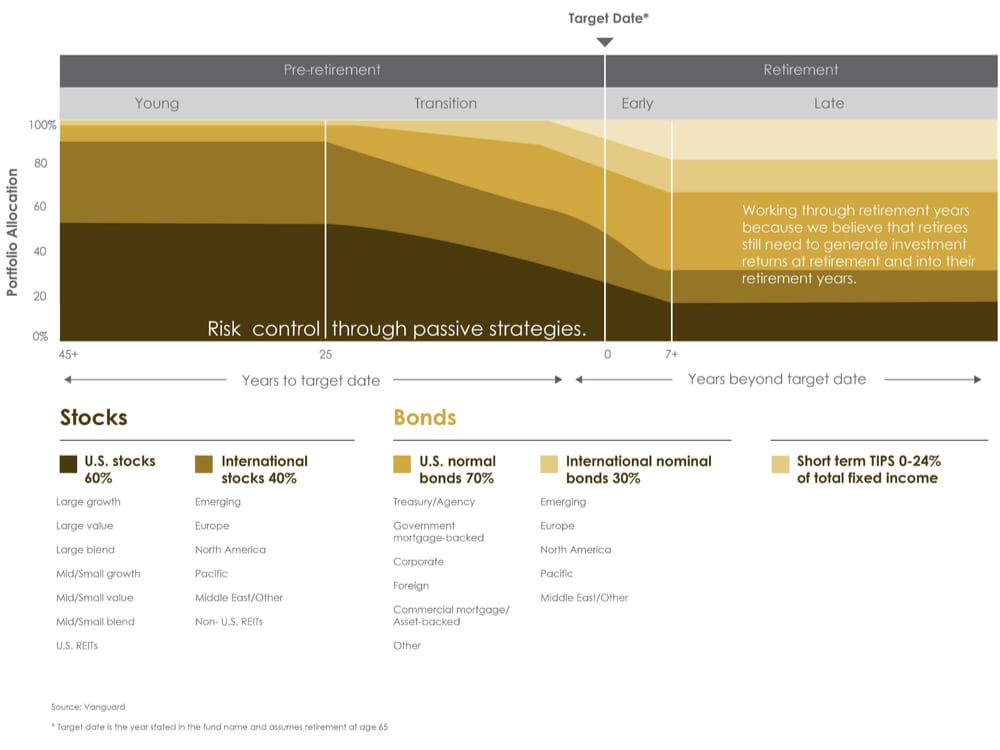

Another important element about target date funds—specifically Vanguard—is that most invest the same percentage in each asset until a certain point of time before retirement. As you can see in the graph provided by Vanguard below, every fund starts to automatically rebalance once you are 25 years out from your retirement date.

The best part about target date funds is that they rebalance automatically as time progresses. You can truly set it and forget it. However, what happens if you want more control over your retirement asset allocation?

Let’s say that foreign and emerging markets are experiencing negative returns. You can own one fund if you’re in a target date fund, and that’s all you have. You can’t get in and out of different asset classes and customize the allocation. The only way to remedy the situation is to sell the entire fund. Thinking like an advisor, you probably wish you had more say in the retirement asset allocation.

Brighton Jones Model Portfolios

The last piece of the puzzle for retirement plan participants in the Brighton Jones community is Brighton Jones model portfolios.

Taking what you’ve now learned about selecting either individual or target dated funds, Brighton Jones Model Portfolio strategies offer a third alternative into the mix. Depending on how far out you are from retirement, you can identify the risk level you are willing to take on. Brighton Jones offers four different risk-based models:

- Aggressive: This portfolio allocates 10 percent to high-quality fixed income, 20 percent to higher-yielding fixed income, and 70 percent to global equities (think U.S., foreign, emerging markets, and real estate).

- Moderate: This portfolio has 25 percent in high-quality fixed income, 20 percent in higher-yielding fixed income, and 55 percent in global equities

- Balanced: This portfolio has 35 percent in high-quality fixed income, 25 percent in higher-yielding fixed income, and 40 percent in global equities

- Conservative: This portfolio has 50 percent in high-quality fixed income, 25 percent in higher-yielding fixed income, and 25 percent in global equities

The investments included in the above allocations are all hand-selected by our investment committee. And we practice what we preach: we provide the exact same investment options to Brighton Jones employees.

We firmly believe that having this model portfolio option in retirement plan accounts helps all plan participants know that they are receiving the best thinking of Brighton Jones. Your account will clearly state the performance for each individual manager, and you’ll be able to determine whether a change is necessary as you push closer to your retirement date.

When your company enlists the help of Brighton Jones, you can meet with a financial advisor throughout the year. The advisor will discuss your goals and objectives and ensure that your portfolio is allocated appropriately.

If you would like to learn how Brighton Jones might be able to help your retirement plan, reach out to our team today. We’re always interested in providing a second opinion free of charge. At the end of the day, we love helping our clients, colleagues, and communities live a richer life!

Read more from our blog: