How the SECURE Act 2.0 Impacts Individual Retirees

The SECURE Act 2.0 was passed on December 29th, 2022, containing over ninety provisions that further increases the complexity of the rules surrounding retirement and employer-sponsored plans. In this article, we’ve synthesized the most important changes from this legislature that have the potential to impact individual’s financial planning strategies. We’ve created a separate article that addresses how the SECURE Act 2.0 impacts employer-sponsored retirement plans.

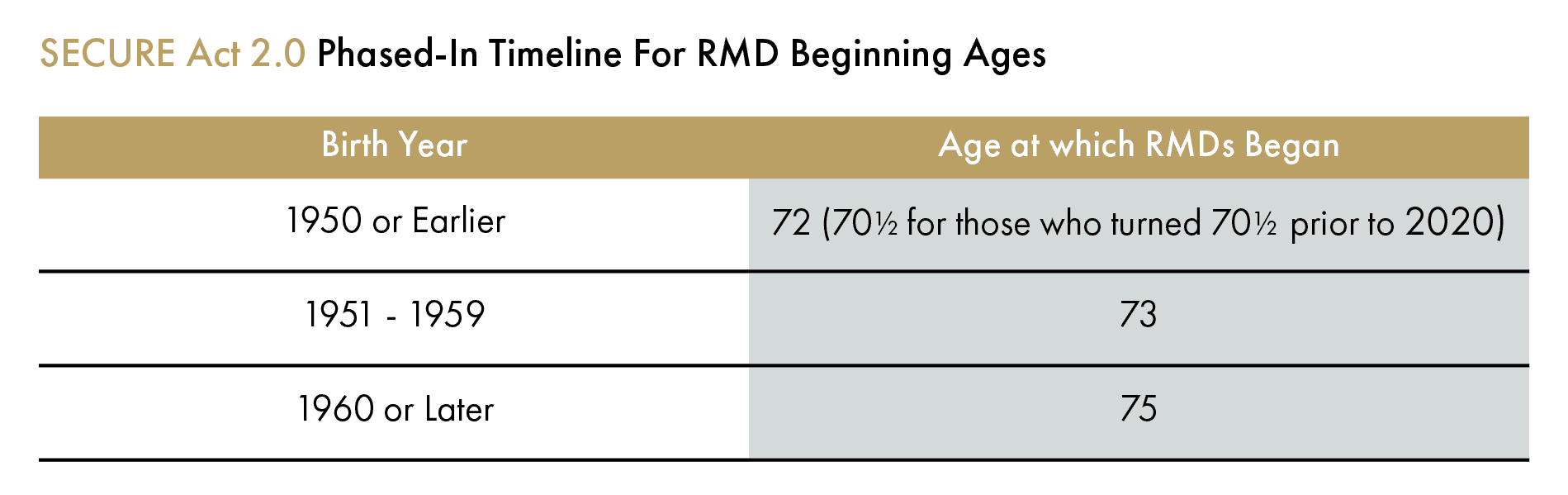

The Required Minimum Distribution (RMD) Age has been pushed back to 73 and eventually will be 75.

For individuals turning 73 in 2023 through 2032, your adjusted RMD age is now 73. For anyone who will be turning 73 in 2033 or beyond, the RMD adjusted age has been pushed back to 75 years old.

It’s worth noting that individuals who turned 72 in 2022 are still required to begin RMDs and will need to take their first distribution by April 1, 2023.

New Option for Surviving Spouse Beneficiaries

Starting in 2024, surviving spouse beneficiaries can identify as the decedent for RMD purposes. By doing so, you can delay RMDs until the deceased spouse would have reached their RMD age.

If the surviving spouse passes before RMDs begin, the new beneficiaries will be treated as though they were the original beneficiaries. This would nullify the 10-Year Rule that would previously have been applicable, thereby allowing these beneficiaries to instead make distributions over their life expectancy.

These changes will primarily impact surviving spouses that have inherited retirement accounts from a younger, deceased spouse.

Limited 529-to-Roth Transfers

Starting 2024, individuals can transfer their 529 dollars into a Roth IRA for the same beneficiary. To do so, the 529 plan must have been maintained for at least fifteen years prior to the transfer and any contribution made within the last five years are considered ineligible. There is a lifetime transfer maximum of $35,000 and an annual limit that’s equal to that year’s IRA contribution limit – currently $6,500 for those under age fifty. Additionally, the beneficiary must have earned income equal to the transfer amount. Income limitations related to Roth contributions do not apply when transferring 529 funds to a Roth.

Roth-Related Adjustments

This bill includes a variety of changes that impact Roth accounts.

- Individuals who are eligible for catch-up contributions (age 50+) who also earn more than $145,000 annually are now required to contribute their catch-up dollars on a Roth basis. If the employer’s plan doesn’t allow Roth contributions, they’re unable to make a catch-up contribution. This is an automatic and mandatory feature of the bill.

- RMDs are no longer applicable to employer sponsored Roth accounts. This includes: 401(k), 403(b), and 457(b) plans. Starting in 2024, Thrift Savings Plans will also be included.

- Employers are now able to make Roth contributions on behalf of their employees in the form of a match only. Profit sharing contributions are not eligible for Roth.

Qualified Charitable Distribution (QCD) Changes

Starting in 2023, individuals are allowed to now fund a split interest entity, such as a CRAT, CRUT, or CGA (Charitable Gift Annuity), up to $50,000 on a one-time basis. It’s worth noting that distributions to a CRAT or CRUT are only eligible as a QCD if the trust is funded exclusively by qualified charitable distributions. Given this limitation, this change primarily impacts funding options for CGAs.

Starting 2024, the maximum annual QCD limit (currently $100,000) will be indexed for inflation. For context, this limit hasn’t been increased since QCDs were originally introduced in 2006.

Catch-up Contribution Limit Changes

Effective in 2025, catch-up contributions for employer sponsored retirement plans are increasing to the greater of $10,000 or 150% of the regular catch-up contribution limit. This provision is only applicable for participants between the ages of 60 and 63. Those participating in SIMPLE plans will have their contribution limits increased to $5,000 or 150% of the regular catch-up amount.

Effective in 2024, IRA catch-up contribution limits will be automatically adjusted for inflation.

Reduced Penalty for Missed RMDs

Lastly, the penalty for missing a Required Minimum Distribution has been reduced from 50% to 25%, effective immediately. If the missed distribution is remedied during the specified correction window, the penalty is reduced to only 10%.

The bottom line: While no single change within Secure Act 2.0 rises to the same magnitude as the initial 2019 Secure Act, the variety and volume of changes included in this update increases the complexity of retirement planning and employer-sponsored plans. Rest assured, our Personal CFO team is well apprised of how these changes impact each our client’s financial plans and will continue to proactively surface unique planning opportunities stemming from this new legislation in an appropriate time frame.