Trust Reveal: Why It Misses the Point for Next-Gen

Preparing the next generation for wealth requires communication, intention, and gradual learning—not surprise “trust reveal” moments.

Read More

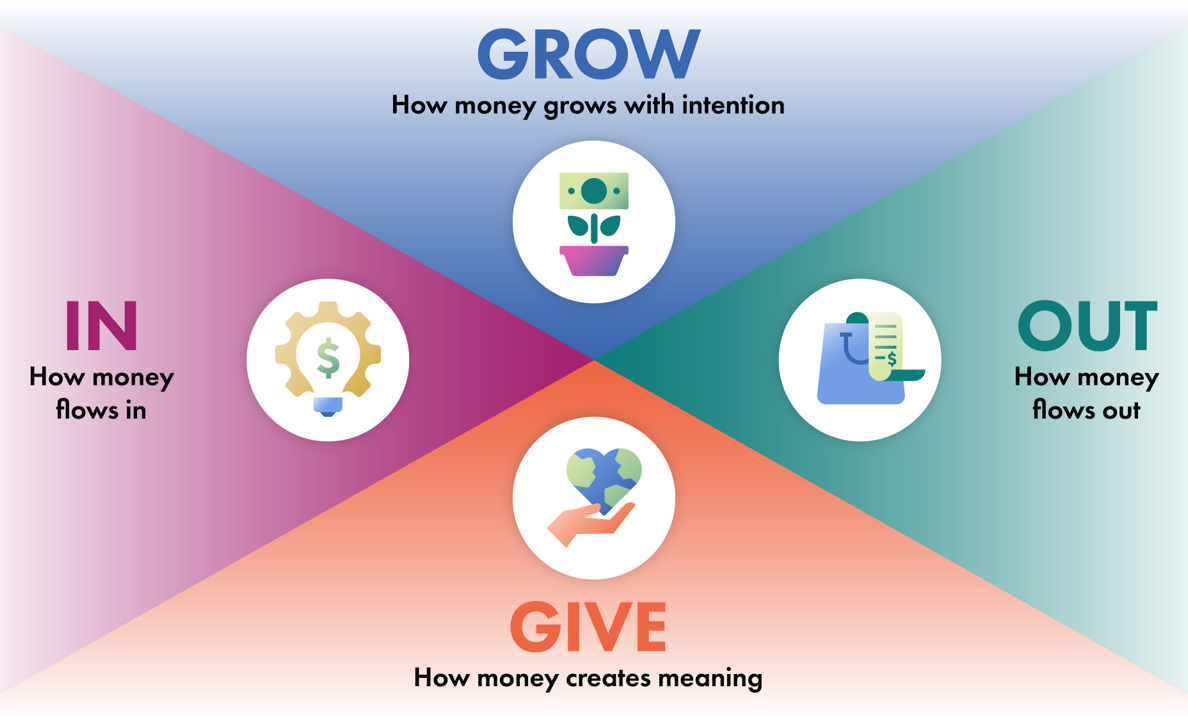

Our Brighton Jones Fin Ed. program helps families navigate the journey from piggy banks to investment portfolios, providing age-appropriate guidance and practical tools for every stage.

Disclosure:

This program provides general financial education only and

does not constitute personalized investment advice or guarantee financial outcomes.